THIS WILL NOT BE A WEEK FOR THE MEEK. In case you haven’t noticed I consider myself to be a stock market junkie, I love the markets. In fact I admired them from afar way before I ever got involved. So this should be one of those weeks which could be memorable if not profitable IF you play your cards right. Its possible this could be the week that sets the tone for the rest of the year.

Before I ever got seriously into Gann wheels which is what the Gann calendar is, I knew about the importance of the seasonal change point. I didn’t realize the calendar for the whole year resets on this seasonal turn. Now throw in the FOMC meeting which is usually a handful of days off the cycle marker. NOT THIS YEAR, it all hits at the same time. Its been a strange week, wouldn’t you say? We got our black swan event and the markets dropped but they didn’t drop the way some bears had hoped.

Now is the time to watch psychology as much as anything else because events are manifesting at breakneck speed. It wouldn’t be so interesting unless you also realize the vibrations tend to support what is going on. So we had the Silicon Valley Bank disaster, the depositors are being made whole. You knew that had to happen because much of wealth at SVB was held by wokesters and Mr. Biden couldn’t piss them off, could he? The next really big shoe was Credit Suisse and I’m here to tell you if they didn’t save this bank, we might be looking at a 1929 event RIGHT NOW. So the Swiss National Bank came to the rescue and ultimately UBS will take over. Finally, there’s First Republic Bank and honestly, I don’t much about them. What I can tell you is word leaked out the powers that be decided to shore up the US Banking system with an injection of $2 trillion according to JP Morgan. They are trying to be quiet about it but the sleuths on Twitter have already made it go viral.

All that’s going to do is create a fresh round of inflation several months from now. The Fed is trapped and many of us saw this coming a hundred miles away. My biggest problem economically with everything they are doing is this is the first time I can remember a higher interest rate environment hit after a lengthy period of poor financial performance in the economy. Oh yeah, Trump told us it was the best economy ever. It wasn’t, its not even close to what happened in 50s, 60s, 80s and 90s. Anyone that tells you different is a bold-faced liar. But Trump’s economy was the best ever compared to what Biden’s done, that’s for sure. The bottom line is we’ve always had increasing rate environments on the heels of good business cycles that were overheating. Now the Fed is afraid to raise rates because it will hurt the banks. They are afraid NOT to raise rates because it will allow inflation to run rampant. Some of us saw this coming and now its here.

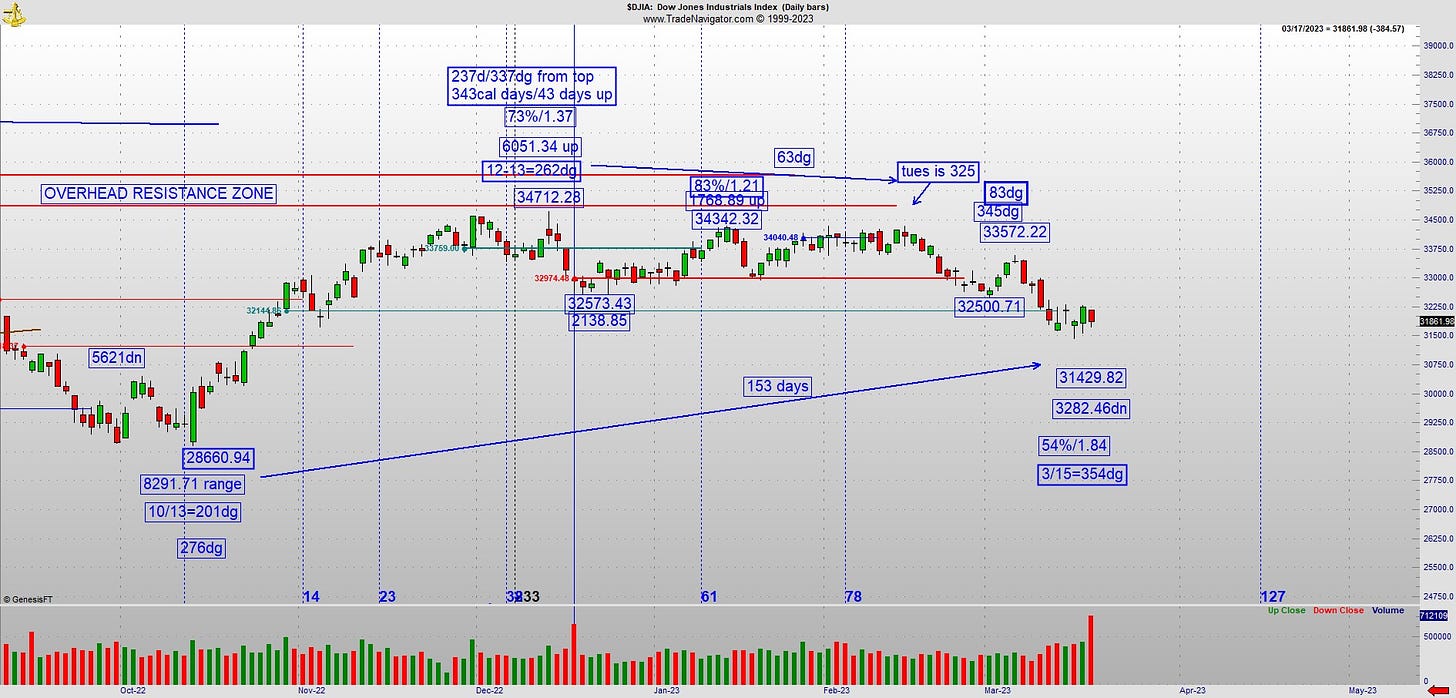

So what are they going to do? That’s Powell’s problem but my interest is seeing crowd psychology as a result of what he does. I do have to show you this Dow chart as its incredibly important.

The net result of Powell/Yellen injecting $2 trillion is an interesting reading in the Dow. This setup in the Dow is not as good as the bullish Bitcoin setup from a year ago but its close. It finds a low on March 15 which is the 354dg vibrational day of the year. Its a 54% retracement to the October low and its 153 days. The only way it could’ve matched that Bitcoin set up is the range misses. Remember on the 166 day, Bitcoin was down 26667 points as well. This one should bounce well and if it doesn’t, that could be the disaster that hasn’t happened yet.

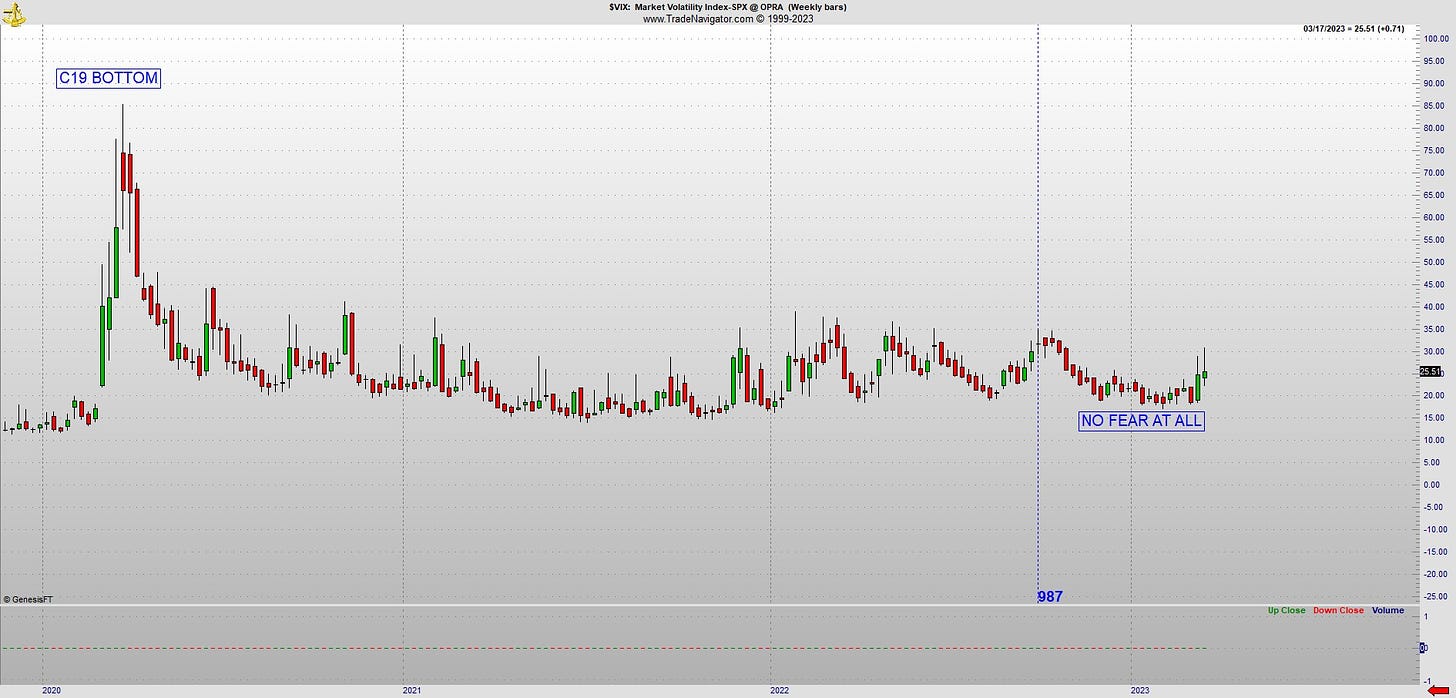

Here’s what I’m finding and maybe its always been like this but I wasn’t sophisticated enough to have picked this up in the 2008 bear market. It seems the hard down hits only after a real bounce attempt fails. See, the bulls look at these strong bounces as evidence of a new bull market. The smart money is looking at it like the rug will get pulled only after the initial excitement wanes. Right now we’ve hit 3 bailouts in a week. Things could stabilize a bit but the VIX only got near 31 which is good enough for an intermediate level low but not a long term one.

I’ll say it again. This is not the kind of fear level which leads to a lasting bottom. We might go through this bailout process any number of times until the crowd realizes there isn’t going to be a new bull market and they all head for the exits at the same time. What kind of black swan will that require? I couldn’t tell you but I would expect more black swans.

The Dow has an interesting low and it will be even more interesting to see how they react to the Fed this week. If it fizzles the way Bitcoin did last year, look out below. Remember I shared that Bitcoin was setup to bounce? One never knows what the amplitude will be but this one was much better than expected as Bitcoin was up near 15% on Monday. Proper placement of trend channels was the reason I was on top of this. I can’t tell you how many trading opportunities reveal themselves as a result of knowing how and when to draw the trend lines/channels properly. The Elliott people believe this is the start of something big for Bitcoin, I wouldn’t go that far but here’s what I can tell you. Look at the weekly below.

This is the weekly and you already know about all the 66/67s on this chart. Right now it started declining at 67 weeks but has violated that relationship to the upside. That’s the first real indication we could be seeing a major change in the character of this pattern. That doesn’t mean some other vibration can’t dominate. What I can tell you is if this were an hourly chart or even a 4 minute chart and a relationship like this violated, it usually means something interesting is developing in the new direction. I’ll give you an example from this week.

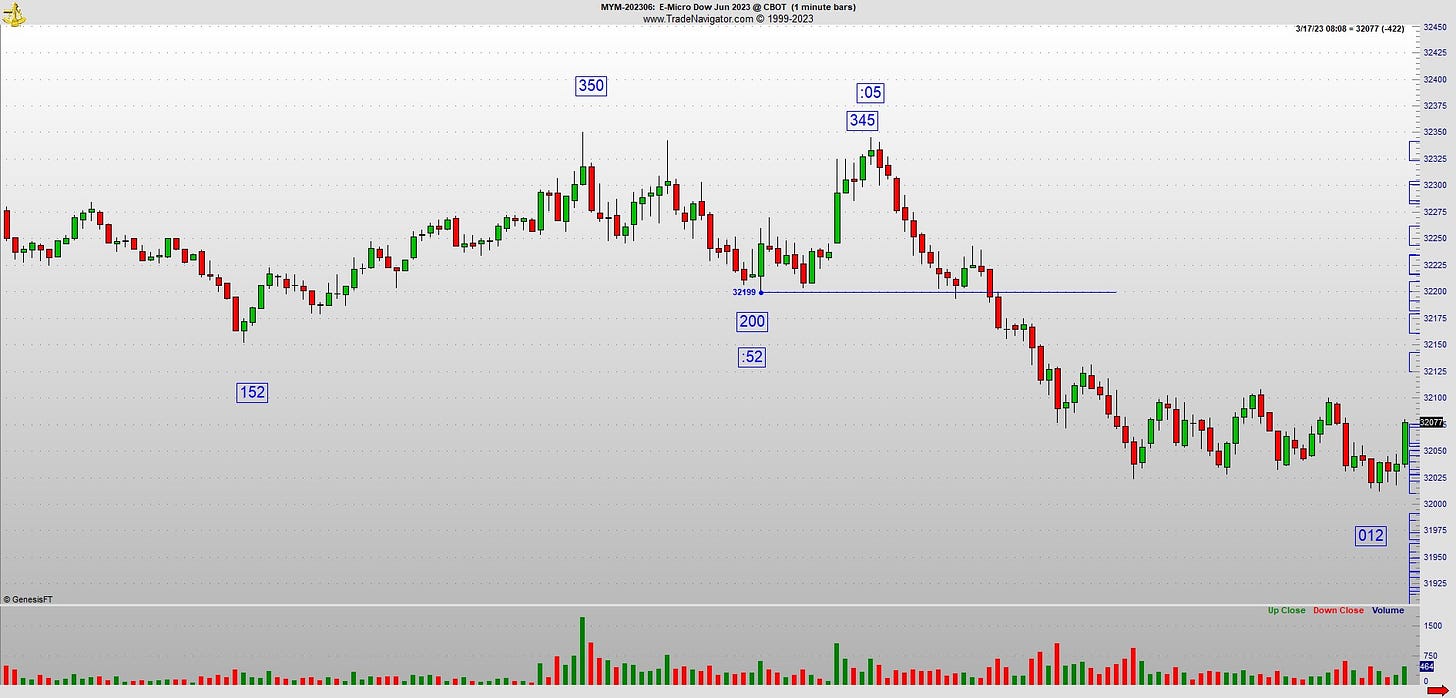

Whenever there is a low, I’m looking for replication on a pullback. In this case early Friday we had a 152 low and at :52 (22min after the open) we got that bounce. Its a 145 point bounce in 13 minutes so nothing wrong with that. The problem is the next thing you knew it was retesting support. Prior to the past couple of weeks, setups like this spawned THE RALLY OF THE DAY. I’m not kidding. Now the character of the market has changed and it fizzled. When it violated (like Bitcoin at 67 weeks) we got a nice continuation of the downtrend. This should now happen in Bitcoin. Study this chart carefully as its one way to stay on the right side of the market. How do you short near support? Only a failure of a nice reading. But something bigger was going on which is also new to this market. See the high at 577? At 76dg from that high, it rolled over and exerted dominance over the 1 minute readings. This is the exact kind of setup we’ve seen for months that worked from the bullish side now working on the bearish side. But now we could be in for another adjustment based on what I’ve shown you in the Dow.

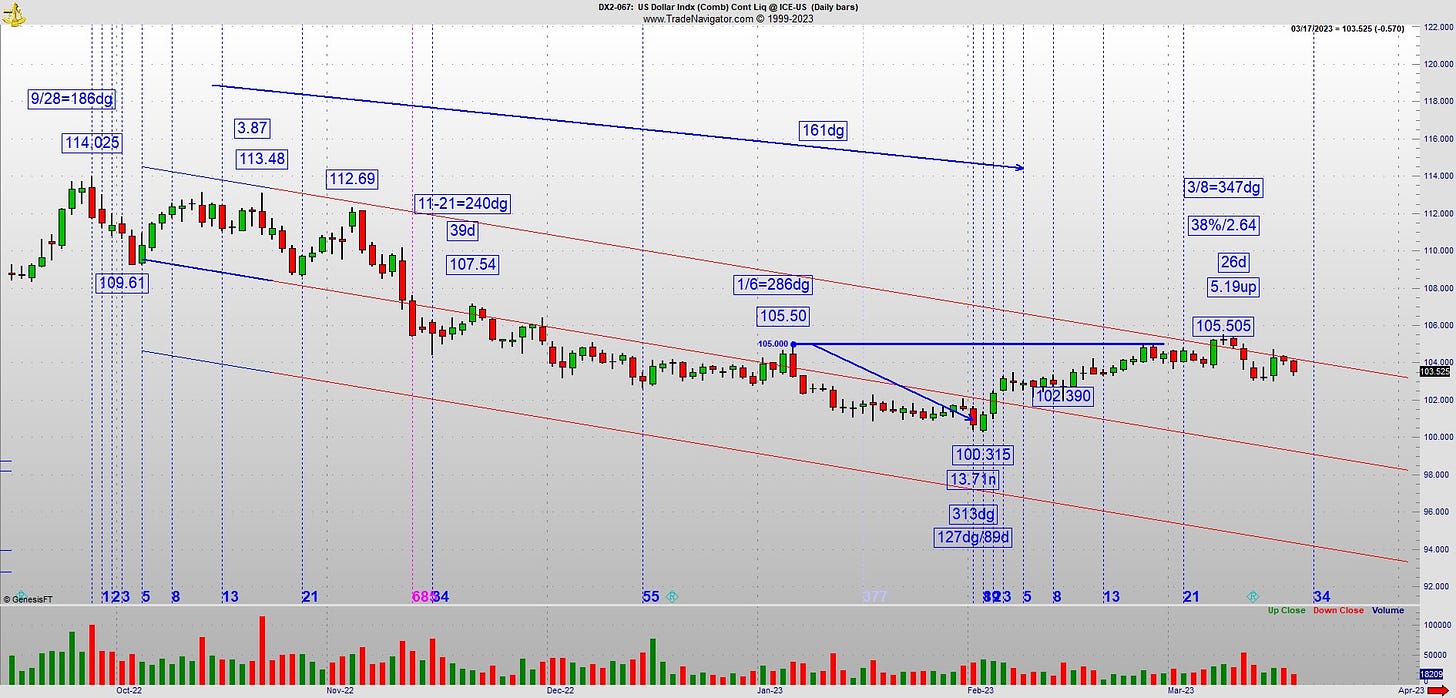

The Dollar hasn’t given up yet although that vibration is working on a small scale right now. Then there’s the BKX which should bounce in the very least based on its positioning in the channel.

They can contain things for a while and even a few months. For my 2 cents, we don’t usually see the market crash this time of year although it can get nasty. Market crashes come in September/October. But we are in uncharted territory. Events are happening we haven’t seen before and it feels like things accelerate from one week to the next. My best advice is keep your head in the charts with the vibrations. If there are manuals you need, contact me. I know there are some of you who never got the Gann calendar, Replication is the Holy Grail and/or the latest which is How Patterns Terminate. These teachings will help you. Yes, its also time to talk about the Moneyshow, I’ll be there next month and I’ll do my best to influence those not familiar with these methods to get familiar with them.

By the way, what I told you about Cramer, apparently Alex J agrees. When the video of Cramer calling SVB a buy went viral, Jones said its Cramer’s job to be sure to get money in the front door while the big time banksters take it out the back door. I’ve come to the educated opinion the whole CNBC operation is set up this way. It was different when Mark Haines was there. When he passed away, the best part of that network died with him.

Concerning bull and bear markets, this might be one of the sneakiest bears we’ve seen. Every time it looks like the bulls can break it out, something else happens to prevent it . That’s why I constantly warn you to watch out for black swan events as they materialize just at the point the bulls get ready to follow through. Be careful.

Interested in your daily Gann manual