The big story prior to Saturday was FOMC Wednesday. Powell chose not to cut rates. Trump is really upset about this but the reality of the situation is we might already be on the other side of a massive recession if they didn’t spend a whole decade keeping rates artificially low. If these leaders can’t figure out another way to get the economy going other than lowering interest rates, we are in very big trouble. Historically, rates are not high. I’m not even getting to the war, yet.

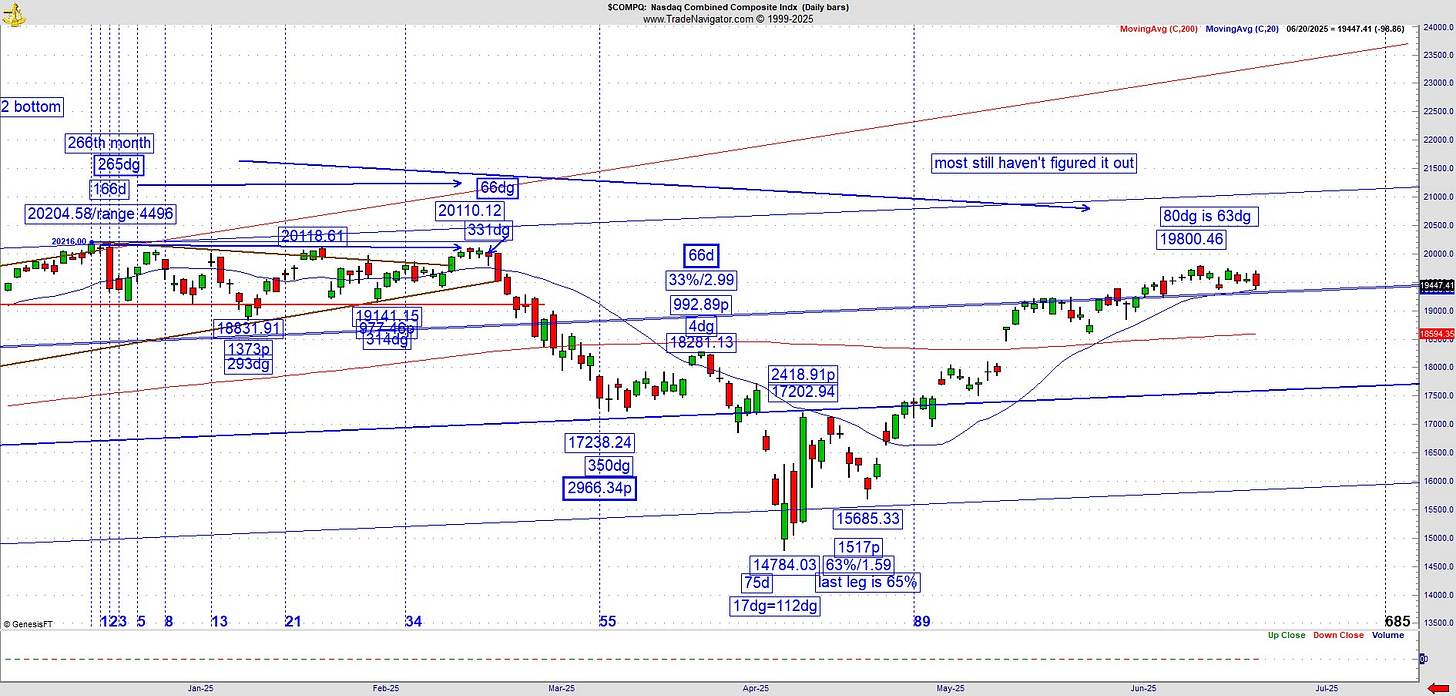

That was the initial big news of the week until the big news hit on Saturday. As you know I’ve been talking bear market since December 16. We’ve also had a rally since April 7 that fooled the best of the best into believing the bottom was likely in. Lots of reputable folks had already come to the point where they believed we were back in the bull market. But there is something different you come to realize after you’ve been through a few of them. This one is nasty in its deception. But its true, our calculations called the low on April 7 and until something changes, we go with it. That being said, you also have to respect the December reading as it took 23 years to build that pivot.

We have to consider ANYTHING, even a new high in the NASDAQ. But the NASDAQ came within something like 600 points of the top. My view all along has been it might take a black swan event to change the direction of the rally. Is it really a stretch with all the problems? I think its a miracle it didn’t hit the fan until now. Don’t forget about the 80 year war and revolutionary cycle.

So the futures market gapped down to open the trading week. What’s most important here is the fact all of this materialized right on schedule on the back end of the June cycles and the seasonal change point. What that really means regardless of market direction is these cycle points we work with every single day not only influence the direction of financial markets, they sync with major events right here on Earth.

Nobody has a crystal ball but I posted a warning as you can see its date stamped June 12. Most of you know it as I posted it in the weekly substack.

Getting back to the Fed, here’s my solution which will only work in an alternate universe. If they took a few of the billions they completely wasted on wars in Ukraine as well as Gaza and invested in rebuilding American infrastructure, we wouldn’t be talking about fudging employment numbers. Every state and city needs infrastructure repair. Why not do it? You know the answer as we do not live in an alternative universe. If you saw the Tucker Carlson/Ted Cruz interview, you know Tucker brought up the exact same thing re:homelessness in America. It was amazing to me how Tucker exposed Cruz. That interview is very revealing on many levels.

Powell didn’t lower rates and the market didn’t rally. That’s everything you needed to know about what happened last week until Saturday. Now we are in a new world, a new portal. Here’s the final word on the Fed.

We are in a situation where Monday was 180 days out from the NASDAQ December 16th top which amazingly was starting to be retested. Now we are sitting at the seasonal change point. In the middle of all that, we didn’t even get ONE SPIKE out of the FOMC announcement. I find that very interesting and it may be the ‘tell’ for the market even as all the AI participants stay bullish to the point of complacency and near laughing gas. (By the way I wrote this particular paragraph on Saturday morning as I always do). The lesson to all of us is reading what the market is trying to tell us. It couldn’t rally.

This is a difficult pattern to trade because practically nobody expects a drop. This is NOT the top so it didn’t necessarily start with a big reversal candle. It hasn’t committed to the downside and in these situations its that first strike down that always takes the crowd by surprise. It was Benjamin Baruch who stated he’s not interested in the first or last 10% of a move but he loves the sandwiched 80%. Right now all we have is a clue, a big clue but not definitive. Markets were not dropping much at all, but since Powell’s announcement, they haven’t been able to rally either. Is that a harbinger for things to come? By they way, NOBODY that I know of figured out the One Hour/60 Minute reading that is also tied into this peak. If you started to digest the One Hour/60 Minute Cycle manual some of you might be ready to figure out that reading on the NASDAQ on your own.

One can make a case the market didn’t rally because the Fed refused to budge on rate cuts. You would be correct. But does the fact we have these readings from December which is a 23 year cycle high also mean its a bear market anyway and by not cutting rates, that’s exactly what you’d expect in the early phase of a bear market? I don’t have the answer to that one.

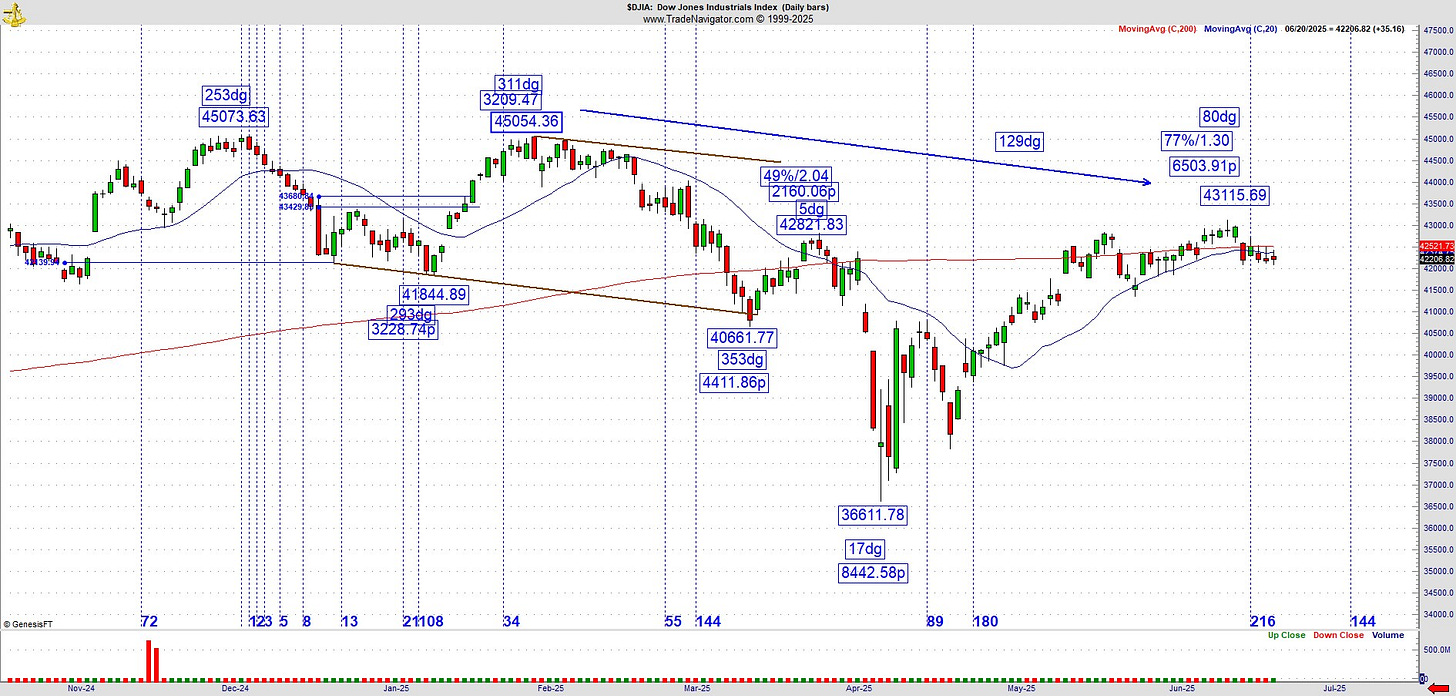

The Dow has a decent reading for a high. Its 129dg off the top while the bigger leg down in relation to the smaller leg up is 1.30x. Its a good match. We are one distribution day away from the potential start of the 3rd or C leg down in this pattern. It might not materialize until August but who knows? This could be the kind of sneaky top most participants only recognize in the rear view mirror. We shall see. Since we don’t impose our will on the markets with the kind of predictions Elliott Wavers make, let me just say conditions are extremely ripe here for a change of direction which may have already begun.

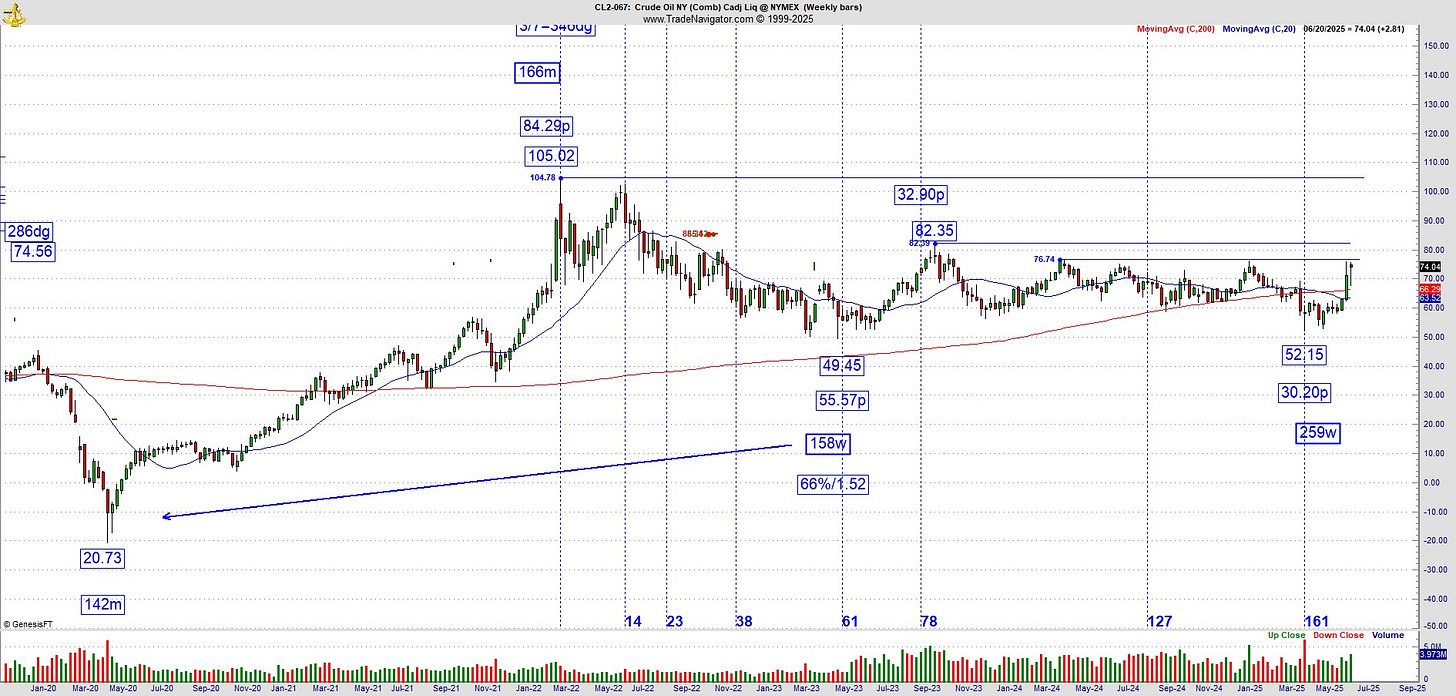

There is one area of the market which might not drop at all and that’s Crude Oil. We don’t look at this chart very often but now it needs to be micromanaged. Especially after Saturday and especially since the Iranian Parliament or whatever they call themselves voted to block the Strait of Hormuz. Final approval from the top had not manifested at the time of this writing. This is going to be a disaster.

Dan at Iallegedly was talking about the possibility of $12 gas because of the war. That’s not likely happening in my state of Arizona but you can’t rule it out for California. I run into those who think war with Iran is a great thing. Alex Jones played some song which is a Beach Boys takeoff called Bomb, Bomb, Bomb Iran. My wife didn’t get it but I told her immediately those who are applauding American exceptionalism and glad for this event proved to me the complacency, euphoria, laughing gas and pixie dust might be at maximum strength right here. What I’m saying is the whole bubble may have just BURST.

These people are shortsighted and don’t seem to realize if war really comes to America it will destroy any hope of an economic recovery mainly because of what could happen at the pump. This is a weekly oil chart and you can see the overhead resistance in 2 places. There’s still a long way to go for the massive breakthrough but what concerns me about this setup is the foundation is very strong. From the bottom, the first major pullback hit at 158 weeks. The current low or start of this really hit at 259 weeks so there is major replication working on this chart. Its already responding so that’s not even up for debate. Oil stocks might stay up if this goes. That’s what makes it tricky. FYI, early Sunday evening it gapped up into the first overhead resistance and stalled. You have to love the replication on the golden spiral number.

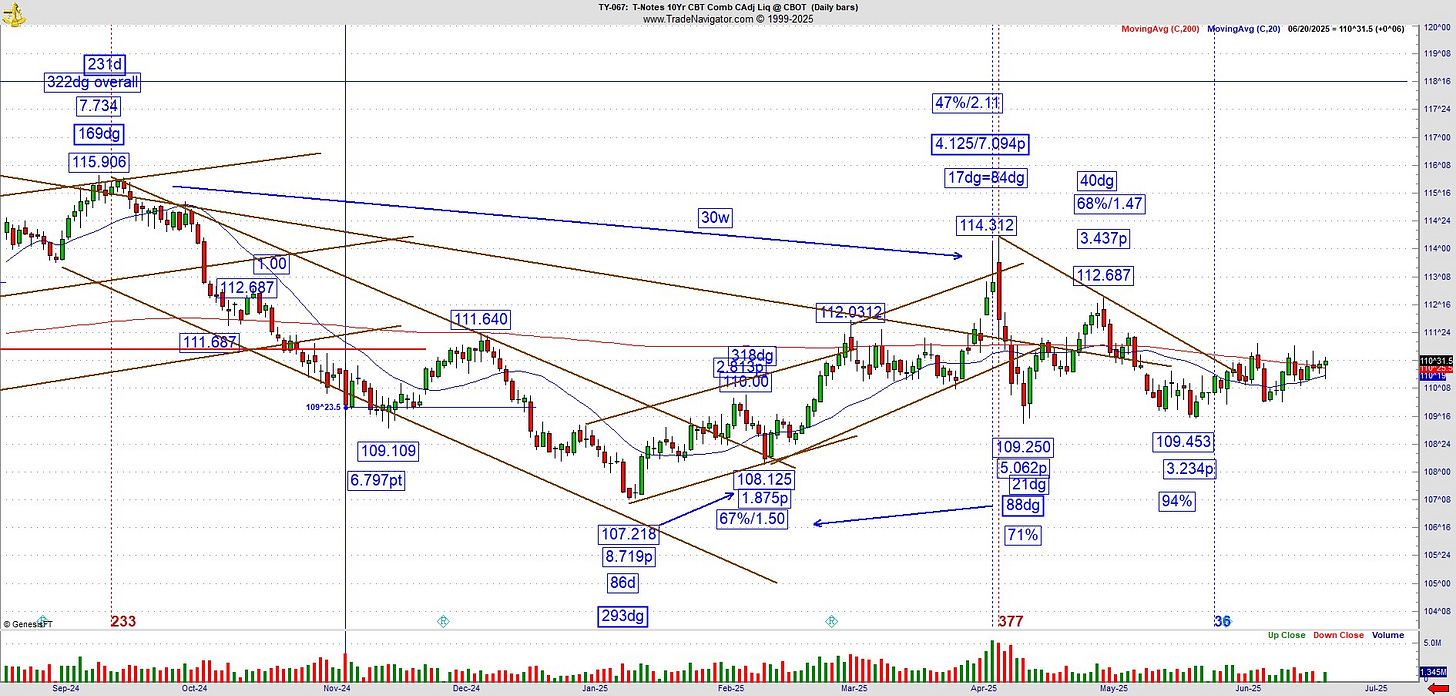

Longer term rates are also at risk. From the recent peak at 114.312 where there is a validated replication flip, we have a secondary high with a 1.47 reading which matches the 47% retracement of the first high. We have a recent low at a 94% retracement which matches the 293dg bottom back in January. This thing is going sideways for now but since the April high there has been an inability to rally. Does that sound familiar? They are doing everything they can not to see a collapse.

The Greenback has reached a point where it should bounce and its trying. This could end up being the fly in the ointment for Gold-bugs who are following the lead of Gerald Celente who believes gold prices should be much higher. They probably will but we take this one week at a time. We have a move of 108dg on the Gann calendar which established the top. Now its 108 days down with a bounce attempt and lots of overhead resistance. Those replication flips are just about the best buy and sell signals out there and most of the market participants don’t even have a clue about it. But here’s the issue, every now and again, they fail on a big time frame and it ushers in an even BIGGER move going the other way. This one is a candidate, we’ll see.

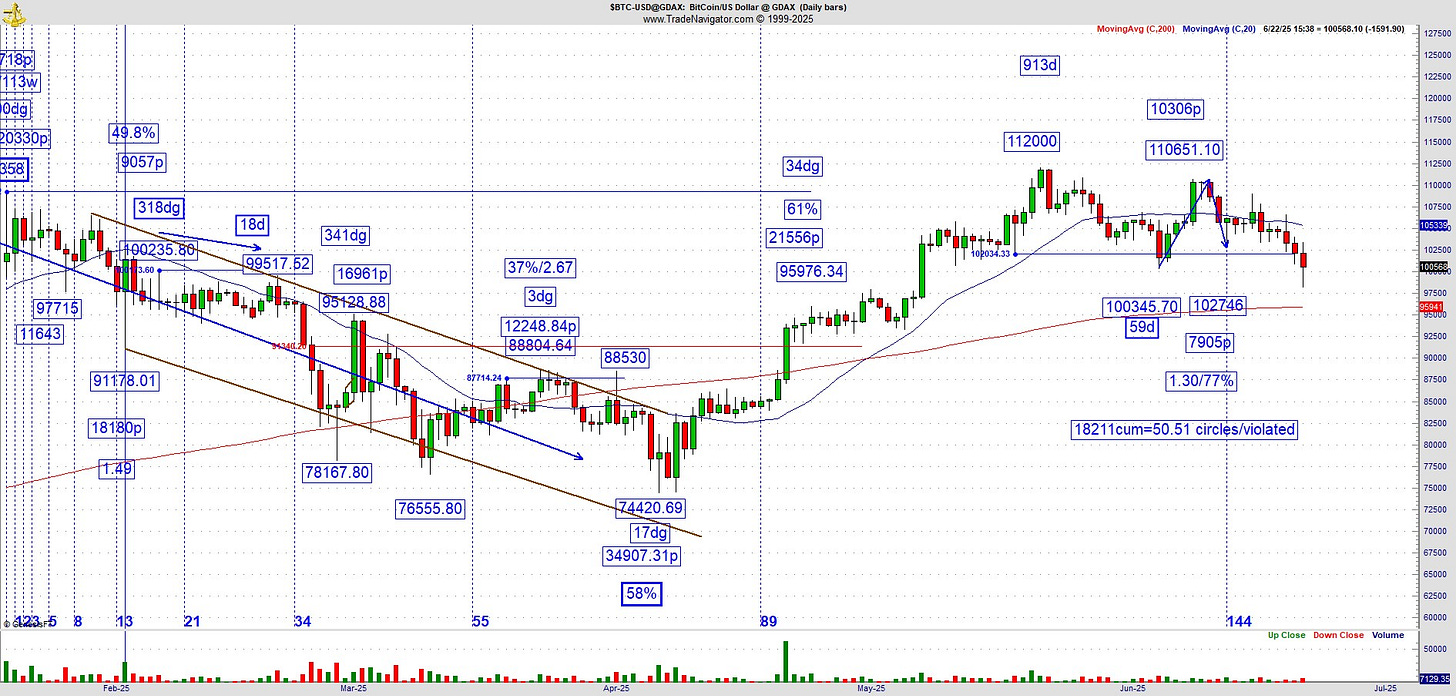

For Bitcoin, it had violated a smallish cumulative reading with its own inability to rally. That’s okay but if it violates the support line and closes lower than the 59d low which is a vibrational master pivot, it will drop down to the 200dma or more. This is the last call for crypto for a while. As you can see on the Sunday night open period, it did violate, that can’t be good.

An hourly gold chart which does NOT look like the bottom. It can and very well should inch lower to that massive support zone just below where we are. IF that were to break, it would be a problem. Right now we might have some shorts starting to cover and anxious early birds who could be FOMOing there way through the day. This chart like oil gapped up and stalled, in this case at the 200 hour moving average.

So that’s it for cycle season. We made it through 180 days off the December high and the seasonal change point where bulls got no help from the Fed. Additionally, No Kings Day (last Saturday) turned out to be a nothing burger but it was important enough to be on the map. That’s good as it could’ve turned into a black swan. But the Black Swan came anyway.

War with Iran? Doesn’t surprise me one bit. I told you 8 months ago Trump would have to pay back the Mossad for them helping him get elected. Its a long story for another day. This whole affair disgusts me but I did warn folks something like this could happen. This has an Iraq feel to it all over again. Weapons of Mass Destruction? You remember Colin Powell accusing Saddam Hussein and none were ever found. Now they tell us Iran is right around the corner from having a nuke. Want your mind blown? Scott Ritter just appeared on a special Sunday edition with Judge Napolitano and he told the biggest audience ever to listen to a Judge Nap podcast the Iranians actually MOVED all their sensitive centrifuges and other components from the 3 nuclear sites that were hit. The one site that did hit some centrifuges destroyed ancient centrifuges that were developed several decades ago. According to him, this whole event is political theater. He basically said all they accomplished is to create 3 massive holes in the desert. Its simply incredible. US intelligence has no idea where the components are and that’s the truth.

I don’t want to talk about what this means to Trump’s future. We’ll save that for another day. What I will leave you with is the website is coming with a complete cutting edge methodology that stands the test of time under the most SEVERE HISTORIAL CIRCUMSTANCES PERFECTLY. Great timing but I saved the most complex task for the end.

That’s why those of you who haven’t acted yet to get One Hour Sixty Minute Cycle should act this week. I have to get this website up there as NOBODY ELSE COMES CLOSE TO THIS TYPE OF INTEL.

Finally, a little about me. YOU DON’T WANT WHAT I JUST RECOVERED FROM. Its not a high temperature, but its exhausting and debilitating. I didn’t have the energy to sit in front of this screen for longer than a few minutes at a time for nearly 12 days. That’s why the website is not done, its 99% at this point and I pray for this being the week. I call it the mystery illness as it hasn’t felt like any flu I’ve ever had. Have any of you had LONG COVID? The fatigue went on for weeks, I had it in 2021. I started getting my real energy back only on Wednesday.

So this could very well be the last call for The One Hour 60 Minute Cycle project going out the door at $177. Many of you have stepped up, a few that I know of have not and if you hesitate I guarantee you’ll have to invest at least an extra $100 if you don’t act this week. Its a game-changer because it takes everything I’ve done for the past 25 years and took it one level deeper. The biggest benefit is you’ll see what really drives the deeper level and put yourself in a position to get to your muscle memory/2nd nature/instinct much quicker and you’ll find yourself catching trades in a better place closer to the actual pivot before you have to chase. Don’t ever chase a move, let it go. Send funds to lucaswaveman@gmail.com thru paypal or request an invoice.